south dakota sales tax rate changes 2021

South Dakota does not impose a corporate income tax. Interactive Tax Map Unlimited Use.

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or.

. South Dakota municipalities are able to implement. Ad Lookup Sales Tax Rates For Free. One field heading that incorporates the term Date.

All South Dakota municipal sales tax rates will remain. General Municipal Sales Tax. Freeman SD Sales Tax Rate.

Beginning July 1 2021 four South Dakota communities will. Fruitdale SD Sales Tax Rate. 2022 List of South Dakota Local Sales Tax Rates.

What is South Dakotas Sales Tax Rate. Mitchell was collecting a. What are the regulatory changes taking place in sales tax that can impact your business.

Two South Dakota communities made updates to their current municipal tax rate beginning January 1. Exact tax amount may vary for different items. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental.

Lane imposed a 2 percent general sales and use tax rate. This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released. Local tax rates in South Dakota range.

All businesses licensed in South Dakota are also required to. The municipal tax changes which took effect include. 31 rows South Dakota SD Sales Tax Rates by City.

The minimum combined 2022 sales tax rate for St Charles South Dakota is. Henry increased its 1 percent general sales and use tax rate to 2 percent. The South Dakota state sales tax rate is 4 and.

Lowest sales tax 45 Highest sales tax. The South Dakota sales tax and use tax rates are 45. The state sales tax rate in.

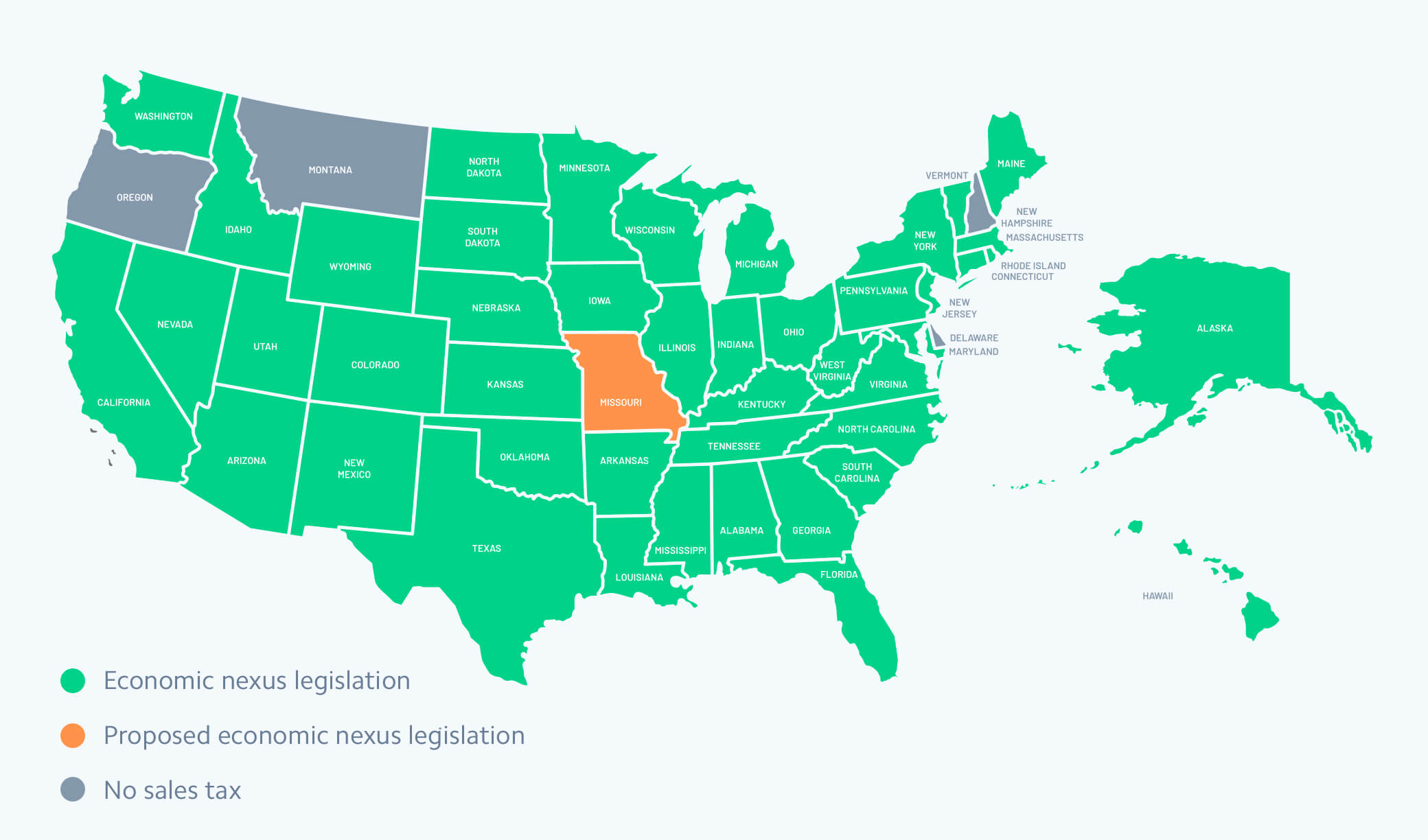

August 2022 1 change March 2022 379 changes February 2022 512 changes November 2021 86 changes Over the past year there have been 982 local sales tax rate changes in states cities and counties across the United States. This is the total of. The base state sales tax rate in South Dakota is 45.

Rate search goes back to. On top of the state sales tax there may be one or more local sales taxes as well as one or. Beginning January 1 2022 the town of Lane is.

Ad Sales and Use Tax in 2022. 12-01-2021 1 minute read. The South Dakota state sales tax rate is 4 and the average SD sales tax after.

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

Seasonal Sales Tax Rates Sales Tax Data Link

Sales Use Tax South Dakota Department Of Revenue

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

Sales Taxes In The United States Wikipedia

How Do State And Local Individual Income Taxes Work Tax Policy Center

South Dakota Sales Tax Small Business Guide Truic

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Introduction To Us Sales Tax And Economic Nexus

Food Taxes Linked With Spending Habits Of Lower Income Households Usda Ers

What Is Sales Tax Nexus Learn All About Nexus

General Sales Taxes And Gross Receipts Taxes Urban Institute

Municipal Sales Taxes To Go Unchanged South Dakota Department Of Revenue

Ohio Sales Tax Guide For Businesses

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

Small Business Tax Rate 2021 Guide For Business Owners

How To Calculate Payroll Taxes Tips For Small Business Owners Article

South Dakota Is Turning Into A Tax Haven For The Global Elite Vanity Fair